Understanding Business Bookkeeping: The Key to Financial Success

In the ever-evolving landscape of business bookkeeping, having a robust system in place is not just beneficial — it is critical for the success of any organization. Bookkeeping is the foundation of any financial management system, and understanding its importance can help you and your business thrive. This article will delve deep into the world of business bookkeeping, explore its intricacies, and shed light on best practices that can propel your business toward financial stability and growth.

The Importance of Business Bookkeeping

Business bookkeeping is the process of recording daily financial transactions in a consistent and organized manner. It may seem mundane, but it serves several key purposes:

- Financial Health Monitoring: Accurate records allow you to track revenue, expenses, and profitability, thus giving you a clear picture of your financial health.

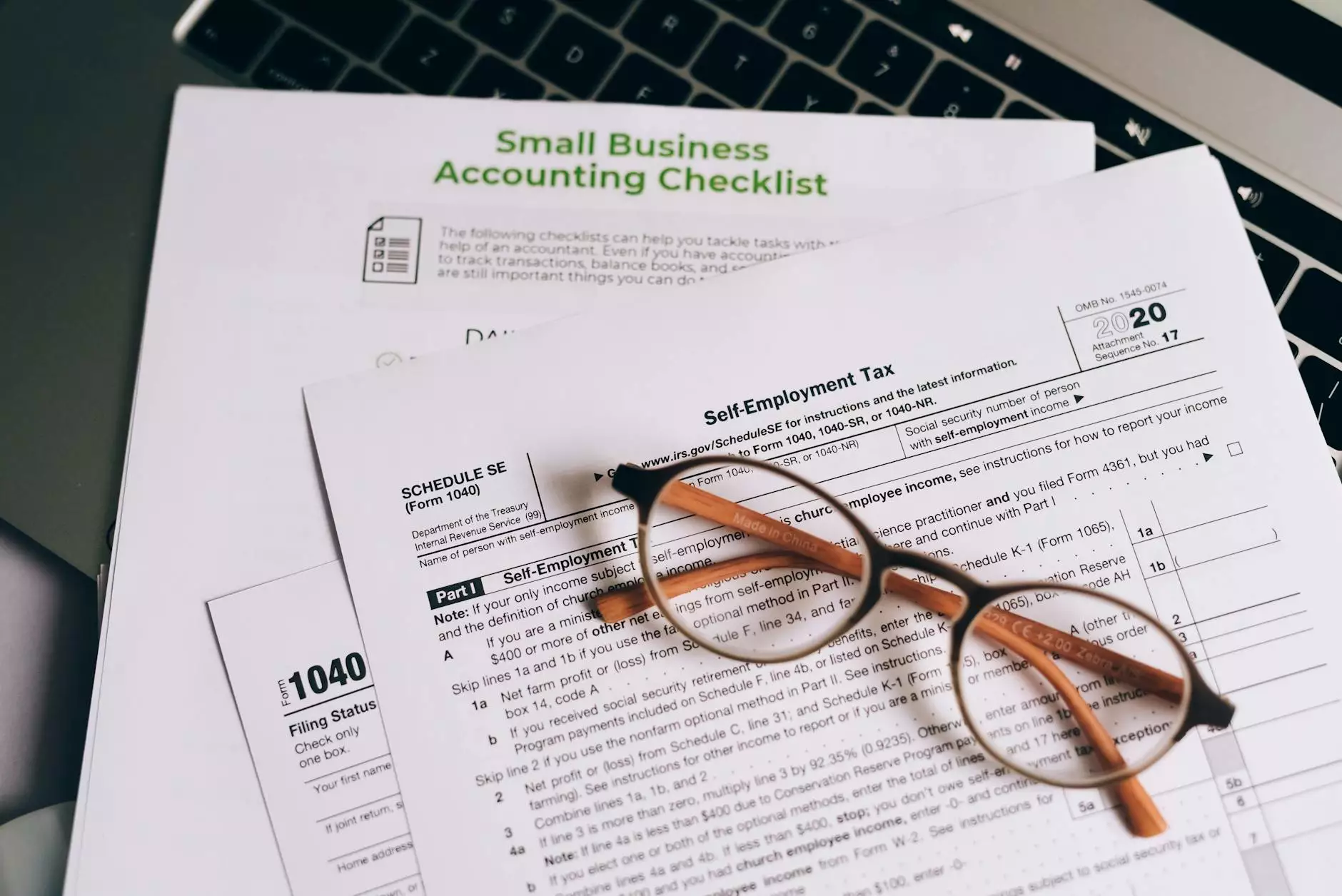

- Tax Compliance: Proper bookkeeping makes it easier to prepare tax returns and ensures compliance with tax regulations, potentially saving your business money on penalties and audits.

- Informed Decision Making: With well-maintained financial records, you can analyze trends over time, helping you make informed business decisions.

Essential Components of Business Bookkeeping

Successful bookkeeping involves several critical components. Here, we break down the essential elements every business should consider:

1. Chart of Accounts

Your chart of accounts is a list of all accounts used in your business’s general ledger. This includes assets, liabilities, equity, revenue, and expenses. Organizing your accounts gives clarity to your financial statements and allows for accurate financial reporting.

2. Daily Transactions

Recording every financial transaction daily holds paramount importance. This includes sales, purchases, receipts, and payments. Maintaining comprehensive daily records ensures nothing is overlooked.

3. Financial Statements

Generating financial statements such as income statements, balance sheets, and cash flow statements is crucial. These documents provide an overview of your financial standing and can be used to assess your business’s performance.

4. Reconciliation

Regularly reconciling your accounts is vital to maintaining the accuracy of your financial data. This involves comparing your internal records to bank statements, ensuring that all transactions match and discrepancies are addressed promptly.

Best Practices for Effective Business Bookkeeping

Implementing effective bookkeeping practices can lead to smoother financial operations. Here are some best practices to consider:

1. Use Accounting Software

Invest in reliable accounting software that suits your business needs. Software like QuickBooks, Xero, or FreshBooks can automate many aspects of bookkeeping, reducing human error and saving valuable time.

2. Stay Consistent

Consistency is key in bookkeeping. Establish a routine for recording transactions and stick to it. This practice helps ensure that your records are always up-to-date.

3. Implement Internal Controls

Set up internal controls to prevent errors and fraud. This includes segregation of duties, requiring dual approvals for significant transactions, and regular audits of financial records.

4. Keep Personal and Business Finances Separate

Mixing personal and business finances can lead to headaches during tax season and in financial reporting. Always use a dedicated business bank account and credit card to keep transactions clear.

The Role of Accountants in Business Bookkeeping

While many small businesses manage their bookkeeping internally, as they grow, the need for professional expertise becomes apparent. Accountants play a vital role in enhancing bookkeeping practices:

1. Expertise and Guidance

Accountants bring professional knowledge to the table. They can provide valuable insights into best practices, helping to refine your bookkeeping processes.

2. Tax Planning and Preparation

Accountants are experts in tax laws and can aid in tax planning to minimize liabilities and ensure compliance with regulations. This is critical for avoiding costly fines and penalties.

3. Financial Analysis and Reporting

Accountants can help interpret financial statements and offer analysis that drives strategic decision-making. Their insights can clarify where the business stands and where adjustments may be needed.

Common Bookkeeping Mistakes to Avoid

Even seasoned business owners can fall prey to bookkeeping mistakes. Here are some common pitfalls and how to avoid them:

1. Not Recording Transactions Promptly

The longer you wait to record a transaction, the easier it is to forget details. Make it a habit to enter transactions daily.

2. Incomplete Records

Failing to keep complete records for all transactions can lead to inaccuracies. Always ensure that you retain documentation for every transaction, including invoices and receipts.

3. Ignoring Reports

Neglecting to review your financial reports can lead to missed opportunities or financial pitfalls. Regularly analyze financial reports to stay informed.

The Future of Business Bookkeeping

As technology continues to evolve, so does business bookkeeping. The future of bookkeeping is likely to be influenced by advancements in automation and artificial intelligence. Here’s what you can expect:

1. Increased Automation

Many routine bookkeeping tasks will continue to be automated, reducing the need for manual input and allowing business owners to focus on strategic initiatives.

2. Integrative Software Solutions

We can anticipate a rise in integrative solutions that combine various financial management tools into one platform, enhancing functionality and user experience.

3. Cloud-Based Accounting

Cloud technology will enable more businesses to access their financial data remotely, providing flexibility and real-time insights into financial performance.

Conclusion: The Pillars of Successful Business Bookkeeping

In conclusion, understanding and implementing effective business bookkeeping practices is crucial for any entrepreneur looking to achieve financial success. By adhering to the essentials of bookkeeping, following best practices, leveraging professional accountant services when needed, and staying informed on industry trends, you can ensure that your financial foundation is solid. Remember, bookkeeping is more than just a task; it is a vital component of your overall business strategy. Embrace it, and watch your business flourish.

For more insights and support on business bookkeeping tailored to your specific needs, reach out to us at BooksLA where our experienced team is ready to guide you through every step of your financial journey.